Ecuador Reaches Debt Deal in Principle With Major Creditors

Ecuador reached a preliminary agreement with some of its largest bondholders to restructure $17.4 billion in outstanding debt, reducing the South American nation’s obligations significantly over the coming decade.

President Lenin Moreno’s government intends to exchange 10 existing bonds maturing between 2022 and 2030 for three new notes due in 2030, 2035 and 2040, reducing the average coupon rate to 5.3%, according to the Finance Ministry. Under the proposal, interest payments would resume at the beginning of next year, while the earliest principal would come due in January 2026. The plan still needs approval from a share of the remaining creditors.

Funds managed or advised by AllianceBernstein, Ashmore Group Plc, BlackRock Inc., BlueBay Asset Management LLP and Wellington Management Company LLP are among those supporting the deal, the ministry said in a statement. It said discussions will continue with other bondholder groups.

“With this, we’re freeing up $16 billion over the coming 10 years,” Moreno wrote on Twitter. The accord generates savings of $1.4 billion this year and practically gives Ecuador a grace period of two years, Finance Minister Richard Martinez added in a conference call.

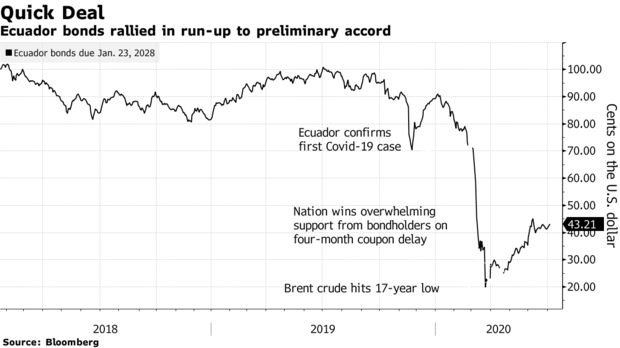

The nation’s benchmark notes due in 2028 advanced to 42.5 cents on the dollar on Monday, more than double their low of 20 cents in late March.

Under the previous administration of Rafael Correa, who was found guilty of corruption in April, the former OPEC member defaulted in 2008 and then aggressively sold debt when the price of oil declined sharply. A plunge in crude prices earlier this year, coupled with the Covid-19 crisis, forced Moreno’s government to ask creditors to consent to a suspension of debt payments while his team negotiated a deal with them as well as the International Monetary Fund.

Fuente: Bloomberg